The Ultimate Guide to Forex Trading Business 1809526063

Understanding the Forex Trading Business

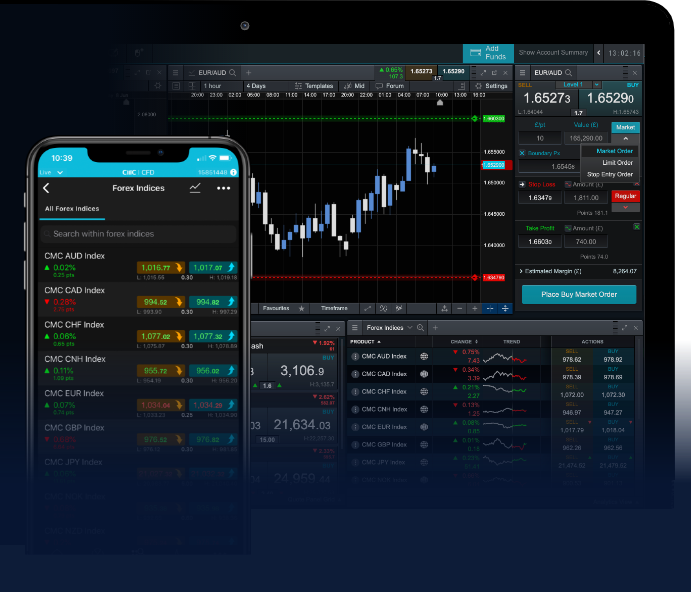

Forex trading, also known as foreign exchange trading or currency trading, has gained immense popularity over the years as a lucrative business opportunity. The foreign exchange market is the largest and most liquid financial market globally, with an average daily trading volume exceeding $6 trillion. This article explores the ins and outs of the forex trading business, including strategies, platforms, and factors to consider for aspiring traders. For anyone looking to get involved, understanding the different trading platforms like forex trading business Indian Trading Platforms can significantly impact the trading experience.

What is Forex Trading?

Forex trading involves buying one currency while simultaneously selling another, with the goal of profiting from the changes in exchange rates. Traders can speculate on various currency pairs, including major pairs like EUR/USD, GBP/USD, and exotic pairs like USD/TRY. The forex market operates 24 hours a day, five days a week, enabling traders to engage in trading at any time that suits them.

Why Trade Forex?

Several factors contribute to the appeal of forex trading. Firstly, the liquidity of the forex market allows traders to enter and exit positions quickly without significant price alterations. Additionally, the use of leverage enables traders to control larger positions without needing substantial capital, thereby amplifying potential profits (as well as risks). Furthermore, the ability to trade various currency pairs opens opportunities for diversification.

Starting Your Forex Trading Business

Launching a forex trading business requires careful preparation and knowledge acquisition. Here are the essential steps:

1. Educate Yourself

Before starting, spend time learning about the forex market, including trading terms, strategies, and analysis methods. There are numerous online resources, courses, and books available to help you understand the complexities of forex trading.

2. Choose a Reliable Forex Broker

Selecting a trustworthy forex broker is crucial for your trading success. Look for brokers that are regulated, have a good reputation, and offer competitive spreads and low commissions. Additionally, consider the quality of their trading platforms and tools.

3. Develop a Trading Plan

A comprehensive trading plan will serve as a roadmap for your forex trading business. Define your trading goals, risk tolerance, strategies, and methods for analysis. It’s essential to stick to your plan and adjust it only as market conditions change.

4. Practice with a Demo Account

Most brokers offer demo accounts that allow you to practice trading without risking real money. Use this opportunity to familiarize yourself with the trading platform, test your strategies, and gain confidence before transitioning to a live account.

5. Start with a Real Account

Once you feel ready, open a live trading account. Start with a small amount of capital, and gradually scale up your investments as you gain experience and confidence. It’s vital to manage your risk appropriately at this stage.

Strategies for Successful Forex Trading

Developing a strategy is essential to succeed in forex trading. Here are popular strategies that traders commonly use:

1. Day Trading

Day trading involves making multiple trades within a single day, aiming to profit from short-term price movements. It requires close monitoring of the market and quick decision-making.

2. Swing Trading

Swing trading focuses on holding positions for several days to capitalize on expected price movements. Traders use technical analysis to identify potential entry and exit points.

3. Scalping

Scalping is a high-frequency trading strategy where traders aim to earn small profits on many trades throughout the day. Scalpers need to be quick and disciplined in execution.

4. Trend Trading

Trend trading involves identifying upward or downward trends and making trades that align with the trend. This strategy requires a good understanding of market momentum.

Risk Management in Forex Trading

Successful traders know that effective risk management is vital for long-term profitability. Here are some risk management strategies to consider:

1. Set Stop-Loss Orders

Stop-loss orders automatically close a position at a predetermined price, limiting losses. Always set stop-loss orders before entering a trade to protect your capital.

2. Use Proper Position Sizing

Deciding how much capital to risk on each trade is crucial. A common rule is to risk no more than 1-2% of your trading capital on a single trade.

3. Diversify Your Portfolio

Avoid putting all your capital into one trade or currency pair. Diversification helps mitigate risks and improves the odds of making a profit over time.

Conclusion

The forex trading business offers an exciting and potentially profitable avenue for individuals willing to invest time and effort into learning the market. By utilizing the right strategies, managing risks effectively, and choosing the right platforms, traders can enhance their chances of success. Remember that forex trading is not without its challenges, and continuous learning is key to staying ahead in this dynamic market.