The Ultimate Guide to Forex Online Trading Platforms 1965707422

The Ultimate Guide to Forex Online Trading Platforms

Forex trading has become increasingly popular in recent years, with a growing number of traders participating in the global currency market. One crucial element to consider for anyone entering this space is the Forex online trading platform. A reliable platform can make a significant difference in a trader’s success. In this article, we will explore the essential features, advantages, and tips for choosing the right Forex online trading platform that suits your needs and boosts your trading success. For detailed information on a trusted trading platform, visit forex online trading platform https://trader-maroc.com/.

What is a Forex Online Trading Platform?

A Forex online trading platform is a software application that allows traders to execute trades, manage their accounts, and analyze market activities. Platforms vary by broker, and they come equipped with various features and functionalities designed to assist traders in making informed decisions. These platforms can be web-based, desktop applications, or mobile apps, providing flexibility for traders to access their accounts from anywhere.

Key Features to Look For

User-Friendly Interface

A user-friendly interface is essential for both beginners and experienced traders. It allows for easy navigation and reduces the chances of making mistakes when placing trades. Look for platforms that provide customizable dashboards where you can place the necessary tools and information at your fingertips.

Real-Time Market Data

The Forex market is highly dynamic, changing rapidly throughout the day. A good trading platform should provide real-time market data, including live price updates and transaction history. This feature is crucial for executing timely trades based on the latest market information.

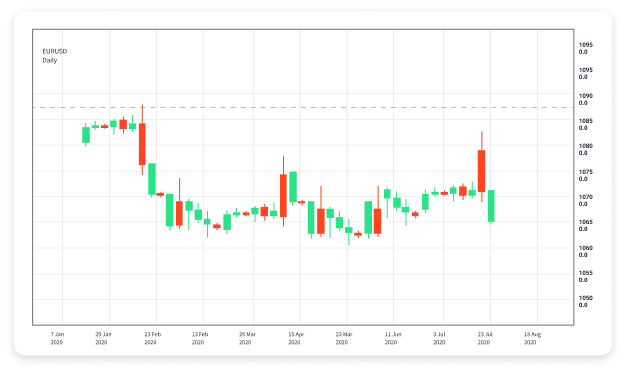

Advanced Charting Tools

Charting tools are vital for technical analysis. These tools help traders analyze price movements and make predictions based on historical data. Look for platforms that offer a variety of chart types, technical indicators, and drawing tools to enhance your analysis.

Risk Management Features

Risk management is a crucial part of trading. Choose a platform that offers features like stop-loss and take-profit orders, which help limit your risk and secure profits. Risk management tools enable traders to control their exposure to the market effectively.

Multiple Account Types

Different traders have varied needs, which is why a good trading platform should offer multiple account types catering to different trading styles and capital levels. Whether you’re a beginner, a professional trader, or somewhere in between, having the option to choose an account that fits your requirements is beneficial.

Customer Support

Reliable customer support is essential for resolving issues that may arise during trading. Look for platforms that provide 24/7 support through different channels like live chat, email, or phone. A responsive support team can make a significant difference in your trading experience.

Advantages of Using a Forex Trading Platform

Access to Advanced Tools

Forex trading platforms often come equipped with advanced analytical and trading tools. These tools help traders conduct in-depth analysis, monitor market trends, and implement strategies effectively.

Security Features

Security should be a top priority when it comes to online trading. Reputable platforms utilize encryption and other security measures to protect user data and finances. Before signing up, ensure the platform is regulated and has a solid reputation in the industry.

Access to Educational Resources

Many Forex trading platforms provide educational resources, including webinars, tutorials, and articles to help traders improve their skills. These resources can be invaluable, especially for beginners looking to understand the complexities of Forex trading.

Choosing the Right Forex Online Trading Platform

When selecting a trading platform, it’s essential to consider several factors to ensure it meets your trading needs:

Regulation and Licensing

Ensure that the trading platform is regulated by a reputable authority. This regulation guarantees a level of safety and security for your funds, as regulated brokers are subject to strict guidelines.

Trading Costs

Consider the fees associated with the platform, including spreads, commissions, and withdrawal fees. Different platforms have varying fee structures, so choose one that offers competitive rates while also providing quality services.

Demo Account Availability

A platform that offers a demo account allows you to practice trading without risking real money. This feature is perfect for beginners who want to learn the ropes before diving into live trading.

Liquidity and Execution Speed

Look for a platform that provides adequate liquidity and fast execution speed. Delays in order execution can lead to missed opportunities or unwanted losses in a volatile market like Forex.

Conclusion

Choosing the right Forex online trading platform is a vital step in your trading journey. By considering the key features and advantages discussed in this article, you can make an informed decision that aligns with your trading goals and strategies. Take your time to compare different platforms and select one that offers the tools, resources, and support necessary for your success in the Forex market.