The Importance of Keeping a Forex Trading Journal 1802495079

Understanding the Importance of Keeping a Forex Trading Journal

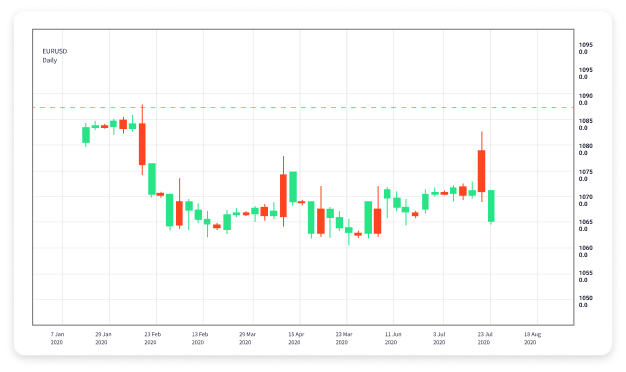

In the fast-paced world of forex trading, it is easy to get lost in the chaos of market fluctuations and emotional decisions. One effective way to gain control over your trading strategy and improve your performance is by maintaining a forex trading journal MetaTrader5 Trading journal. A forex trading journal is not just a record of your trades; it is a powerful tool that can provide insights, help you learn from your experiences, and refine your trading strategies over time.

What is a Forex Trading Journal?

A forex trading journal is a comprehensive log that includes detailed entries about your trades, including the reasons for entering and exiting positions, the strategies employed, and the outcomes. This journal can be maintained in various formats, from traditional notebooks to digital spreadsheets or specialized trading software. Regardless of the method, the key is to consistently track various performance metrics and emotional reflections.

The Benefits of Keeping a Forex Trading Journal

1. Enhanced Self-Reflection

One of the primary benefits of maintaining a trading journal is the opportunity for self-reflection. By reviewing your past trades, you can identify patterns in your decision-making process. This reflection can lead to insights about your emotional responses during both winning and losing trades, helping you to manage your emotions better in the future.

2. Improved Strategy Development

A trading journal allows you to document the effectiveness of your strategies. By analyzing your past trades, you can determine which strategies yielded the best results and which did not work as expected. This iterative process of trial and error is essential for evolving your trading approach.

3. Increased Accountability

Keeping a journal increases accountability. When you document your trading decisions and outcomes, you are more likely to adhere to your trading plan. This discipline can help you avoid impulsive mistakes and guide you to make decisions based on analysis rather than emotions.

4. Better Risk Management

Forex trading is inherently risky. A journal can help you analyze how well you manage risk across your trades. You can document your position sizes, stop-loss orders, and overall risk exposure. Over time, this information will enable you to fine-tune your risk management strategies, ultimately leading to more sustainable trading habits.

Key Components of an Effective Forex Trading Journal

1. Trade Details

Every journal entry should begin with the fundamental details of the trade, including:

- Date and time of the trade

- Currency pair traded

- Entry and exit points

- Position size

- Profit or loss realized

2. Reasoning Behind Each Trade

It is crucial to document your rationale for entering and exiting trades. Include your analysis, indicators you relied on, and market conditions at the time. Understanding the ‘why’ behind your trades will help you refine your decision-making process.

3. Emotional Reflections

Being a trader often evokes strong emotions. It’s essential to record how you felt during your trades. Did you feel confident, anxious, or fearful? Analyze how these emotions influenced your decisions and outcomes, and work on strategies to improve emotional regulation.

4. Overall Performance Analysis

Periodically, review your journal entries to assess your overall trading performance. Look for metrics like win rates, average profit/loss per trade, and drawdown periods. By analyzing your performance data, you can make informed adjustments to your trading strategies.

How to Start a Forex Trading Journal

Starting a trading journal can seem daunting, but it can be tackled step-by-step:

- Choose a Format: Decide whether you prefer a physical notebook, a digital spreadsheet, or specialized trading journal software.

- Set Up Your Template: Create a template that includes the critical components listed above. Make sure it’s easy for you to fill out and review.

- Document Every Trade: Commit to recording every trade you make, regardless of the outcome.

- Review Regularly: Set aside time weekly or monthly to review your entries. Look for patterns in your trading behavior and outcomes.

Conclusion

A forex trading journal is not just a tool; it is an essential part of your trading journey. By systematically documenting your trades, emotions, and analyses, you enhance your ability to learn and adapt as a trader. As you commit to this practice, you will likely find that your trading performance improves, allowing you to achieve your goals in the forex market.

Ultimately, the lessons learned from your trading journal can shape your trading philosophy and strategy, making it easier to navigate the complexities of the forex market with greater confidence and success.