Professional Guidelines for Developing a Forex Trading Framework 1956592594

Professional Guidelines for Developing a Forex Trading Framework

In the fast-paced world of Forex trading, having a structured and well-defined trading framework is crucial for success. A solid framework not only enhances your trading strategies but also incorporates essential risk management practices. In this article, we will delve into the components of an effective Forex trading framework, offering professional guidelines that cater to both novice and experienced traders. For more insights, visit forex trading framework professional guidelines forex-level.com.

1. Understanding the Forex Market

Before diving into trading, it’s imperative to understand the dynamics of the Forex market. The Forex market is decentralized and trades currencies globally 24 hours a day. It operates through a network of banks, brokers, and financial institutions, and its value is influenced by various factors including economic indicators, political events, and global market trends. Familiarizing yourself with these concepts will form the foundation of your trading framework.

2. Establishing Trading Goals

Setting clear and achievable trading goals is essential for a successful trading journey. Your goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Whether your aim is to generate a consistent monthly income or to grow your trading capital over the long term, having defined objectives will guide your strategies and decisions.

3. Developing a Trading Strategy

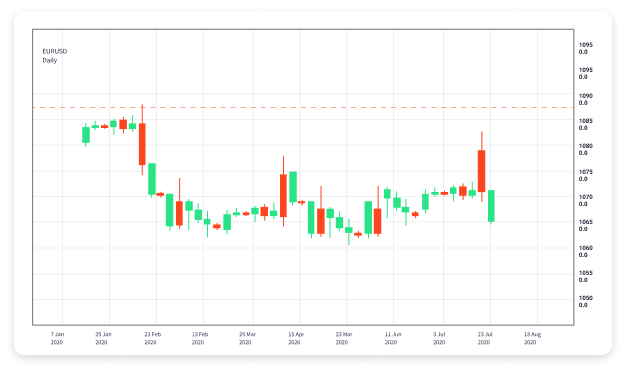

A trading strategy is a set of rules that dictate how and when you will enter and exit trades. There are various strategies traders can adopt, including:

- Technical Analysis: Using price charts and indicators to forecast future price movements.

- Fundamental Analysis: Analyzing economic indicators, news releases, and other factors that impact currency values.

- Sentiment Analysis: Gauging market sentiment through indicators like the Commitment of Traders (COT) report.

Choose a strategy that aligns with your trading style and goals. Backtesting your strategy on historical data can help evaluate its effectiveness before applying it in live trading.

4. Risk Management

One of the most critical aspects of Forex trading is managing risk. A robust risk management plan can protect your capital and ensure longevity in trading. Key components include:

- Position Sizing: Determining how much of your capital to risk on each trade based on your trading strategy and risk tolerance.

- Setting Stop-Loss Orders: Placing stop-loss orders can limit potential losses and protect your account from significant drawdowns.

- Diversification: Avoid focusing on a single currency pair; diversifying your portfolio can mitigate risks associated with specific markets.

5. Trading Psychology

Emotional discipline is vital in Forex trading. Traders must be aware of their psychological state and how emotions can impact trading decisions. Common psychological pitfalls include:

- Fear: Fear of losses can lead to hesitation, causing traders to miss opportunities.

- Greed: The desire for more profit may result in overleveraging and poor decision-making.

- Overconfidence: Past successes can lead to a false sense of security, prompting traders to take unnecessary risks.

Implementing self-discipline practices, such as sticking to your trading plan and taking breaks when feeling overwhelmed, can help mitigate these issues.

6. Continuous Learning and Adaptation

The Forex market is constantly evolving, and ongoing education is paramount for staying profitable. Traders should invest time in:

- Staying Informed: Keep up with economic news, market trends, and global events that affect currency values.

- Attending Webinars and Workshops: Engage in educational resources offered by trading communities and professionals.

- Participating in Trading Communities: Networking with other traders can offer fresh insights and diverse perspectives on trading.

7. Utilizing Technology

In today’s digital age, leveraging technology can significantly enhance your trading experience. Consider using:

- Trading Platforms: Platforms like MetaTrader or TradingView provide tools for technical analysis, charting, and automated trading.

- Trading Bots: Automated trading systems can execute trades on your behalf based on predefined criteria.

- Mobile Trading Apps: These allow you to trade on-the-go, providing flexibility to monitor the market at all times.

8. Review and Refine Your Framework

Your Forex trading framework should be a living document – regularly review and adjust it as necessary. Conduct trade reviews to analyze what worked and what didn’t, and refine your strategies accordingly. Keeping a trading journal may also help in tracking your progress and understanding your trading habits.

Conclusion

In conclusion, developing a Forex trading framework is an essential step towards achieving consistent success in the market. By understanding the market, setting clear goals, implementing effective strategies, managing risks, maintaining emotional discipline, engaging in continuous learning, utilizing technology, and refining your approach, you can create a solid foundation for your trading endeavors. Remember that Forex trading is not a guaranteed path to success; it requires dedication, patience, and continuous adaptation. Best of luck in your trading journey!